“Low transaction fees make Bitcoin more accessible”

As Bitcoin becomes more widely adopted around the world, the debate over transaction fees and network security continues to rage. Low transaction fees make Bitcoin more accessible, especially in developing countries, but some argue that cheap transactions could eventually undermine the long-term security of the network.

Dennis Potter: Low fees are a positive force

Bitcoin advocate Dennis Potter believes low fees are not a weakness but an opportunity.

“Low Bitcoin transaction fees allow users in developing countries to continue participating in the Bitcoin base chain. People's lives will be completely changed in a positive way if they achieve this feat.”

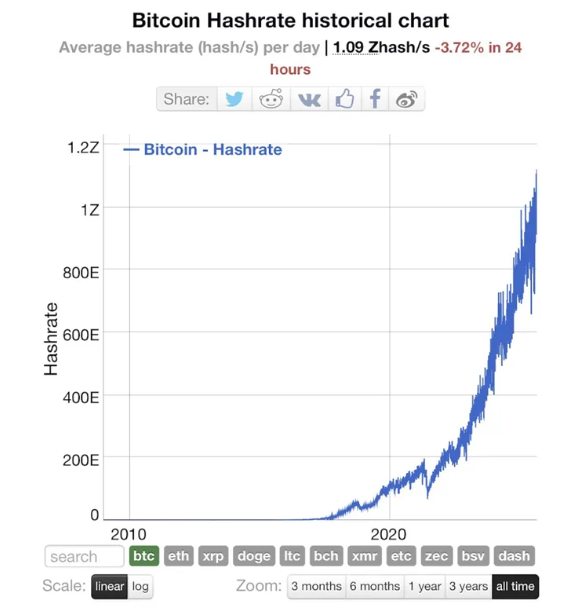

Potter pointed to the network's strong fundamentals, noting that miners are currently being paid handsomely:

“Hash rate hits ATH. Average rewards near ATH. No issues. Security is intact and growing.”

He also dismissed calls for premature changes to the Bitcoin codebase:

“We can solve problems when they show up. Adding code to solve a problem that will take 10+ years to solve is just short-term thinking masquerading as long-term thinking.”

Responding to Potter, community member J.Dog warned that the issue may not be urgent at the moment but could become serious in the future.

“In the short term this is not a problem but in 15 years it will become a real problem if the buildings remain empty.”

He noted that with Bitcoin halving cutting rewards every four years and more transactions moving off-chain, miner incentives could weaken.

“If Bitcoin needs a high security budget, fees have to increase and we will see full blocks. Miners do not work for free.”

According to J.Dog, building a strong on-chain economy and driving demand for block space is key to ensuring long-term security.

Bitcoin Hash Rate Hits 1 Zetahash for the First Time in History

Bitcoin recently reached a historic milestone: reaching 1 Zetahash of mining power for the first time in history. An observer explained :

“This means there is more useful energy in the world that has no more productive purpose than Bitcoin mining – otherwise, the people who own that energy would be doing something else.”

Spike in hashrate signal:

Security Resilience – A 51% attack is already unreasonably expensive; every additional watt of hashing power makes such attacks less practical.

Miner Efficiency – Higher hash rates will weed out the least efficient miners, forcing them to capitulate or sell their BTC, while more efficient miners can continue to hold.

Shift to Fracturing & Multipurpose Energy – More and more mining operations are using energy that would otherwise be wasted (like gas for oil rigs) or used for heating. These miners will have lower costs and less pressure to sell BTC, reducing the overall selling pressure in the market.

This dynamic creates a healthier ecosystem where efficient and sustainable miners prevail and Bitcoin price stability benefits from reduced forced selling.

The Road Ahead for Bitcoin

The debate highlights a central question for Bitcoin's future: should developers act now to prepare for diminishing rewards or wait until signs of stress appear?

For Potter, the answer is clear: Bitcoin is stronger than ever, with record hashrate and mining revenue. For critics like J.Dog, ignoring the security budget risks fracturing the platform in the years to come.