Arthur Hayes Says Bitcoin Will Outperform Stocks and Gold, Predicts Price Will Hit $200,000

Bitcoin has been relatively quiet lately, and some investors are concerned that it is lagging. However, Arthur Hayes, co-founder of BitMEX, says the coin is actually leading the way.

In an interview with veteran Bitcoin and Web3 entrepreneur Kyle Chasse, Hayes urged investors to be patient with Bitcoin, even as stocks and gold hit record highs. He shared his views on the current state of Bitcoin, the cryptocurrency market in general, and the financial world.

Bitcoin Still Leads Over Stocks and Gold

Hayes dismissed the idea that Bitcoin is “lagging” stocks, gold, or global liquidity. While traditional markets are hitting all-time highs, he reminded investors that Bitcoin is the best performing asset in history against currency devaluation.

He dismissed short-term thinking in the crypto space. “ If you think you’re going to buy Bitcoin and the next day you’re going to buy a Lamborghini, you’re probably going to get liquidated because that’s not the right way to think,” he said. “Anyone who bought Bitcoin two, three, five, or 10 years ago is laughing, ” he added, noting that long-term holders aren’t worried about sideways price movements.

He also explained that while the S&P 500 and the housing market look strong in dollar terms, the index has yet to recover to 2008 levels when compared to gold. He noted that only large US tech companies have held up against gold.

“If you discount Bitcoin, you can’t even see it on the chart. It’s ridiculous how well Bitcoin has done,” he said, noting Bitcoin’s outperformance.

Hayes also said people are underestimating the upside potential of stocks, cryptocurrencies and everything. “ I don’t believe in four-year cycles. I believe we can continue to push past $150,000 to $200,000 for Bitcoin because of this massive macro overlay that’s happening right now between now and the end of the decade,” he said.

Fed Rate Cut Could Push Bitcoin Higher

Hayes also shared his views on monetary policy, saying the Federal Reserve is currently in a rate-cutting cycle. He predicted a dramatic move at its next meeting, possibly a 50 basis point cut.

At the same time, he warned that inflation is likely to remain high for the next 18 to 24 months. His message to investors is clear: If you don't hold hard assets like Bitcoin, gold, or at least strong US stocks, you stand to lose out as inflation erodes value.

Bitcoin still holds strong

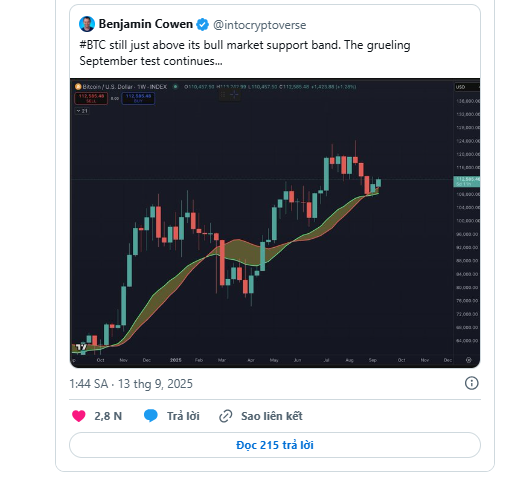

Despite the doubts, Bitcoin is still holding above the bull market support band, as of mid-September. Expert Benjamin Cowen noted that Bitcoin dominance only increased by 0.04% in September, and large increases usually occur in October and November.

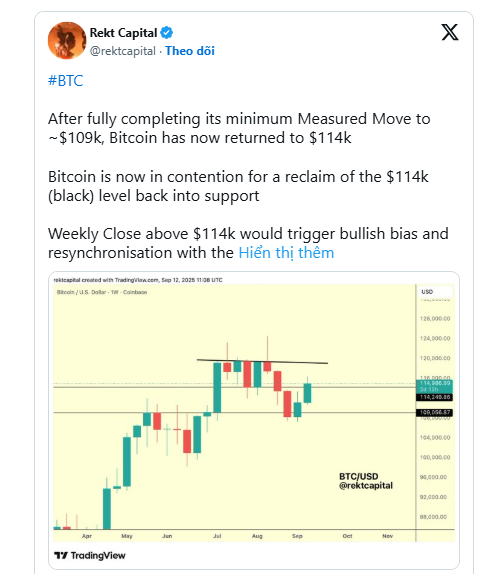

Cryptocurrency analyst Rekt Capital shared that Bitcoin completed its measured volatility low to around $109,000 and has since rallied back to $114,000. Currently, Bitcoin is trading at $116,036.

He explained that a weekly close above $114,000 would turn it into support and could fuel an upside move towards the $114,000–$120,000 range.