US Government Shutdown Hits Markets Hard: Stocks, Gold and Crypto React

The U.S. government is officially shut down, and markets are starting to feel the effects. Investors are bracing for uncertainty as they fear important economic reports could be delayed and market volatility is expected to increase.

Read on to learn more about the market impact and cryptocurrency outlook.

Closing down, market reacts

The government shut down after Congress failed to pass a bill to maintain federal funding. US stock markets fell, the dollar weakened and gold prices hit record highs.

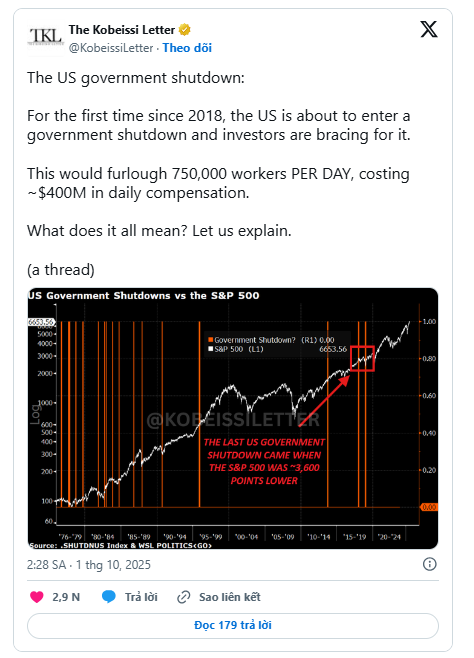

The government shutdown stems from a disagreement between Democrats and President Trump over health care spending. The Congressional Budget Office estimates that 750,000 workers could be furloughed (sent home without pay), costing about $400 million a day in lost wages. This could slow spending and hurt the economy.

Markets prepare for volatility

Analysts predict the shutdown will last one to two weeks with limited economic impact if resolved quickly.

The most recent U.S. government shutdown was in December 2018 and lasted 35 days, the longest on record. While shutdowns disrupt many government functions, they rarely hurt the stock market in the long run. In fact, the S&P 500 rose during 86% of the shutdowns a year later.

In the short term, however, lockdowns often cause volatility. Gold, which has risen 45% year to date, continues to rise as investors seek safe havens, while the US dollar is on track for its worst year since 1973.

Bitcoin is holding steady at $116,419, up more than 3% in the past 24 hours. Bitcoin's reaction to previous US government shutdowns has been mixed. The total cryptocurrency market capitalization also reached $4.09 trillion, up 3% from yesterday.

With the Federal Reserve cutting interest rates while inflation remains high, investors are chasing higher-yielding assets, creating conditions for more market volatility.

Is important economic data at risk?

The government shutdown could delay key economic reports like employment data, the trade balance, CPI and PPI. These numbers are what markets rely on to track growth, inflation and the Fed's next moves.

Experts warn that if the shutdown blocks key economic data, even small setbacks could trigger a market correction.

Will Crypto ETF Approval Be Delayed?

The shutdown could stall progress on crypto ETF approval.

Nate Geraci , president of NovaDius Wealth Management, noted that some issuers were hoping to get approval for a spot SOL ETF next week, but the shutdown could disrupt that timeline.

Cryptocurrency traders are watching closely.

Trader Doctor Profit warned that this could delay key reports like NFP and CPI just weeks before the Fed's October meeting. He also pointed out that quarterly options are expiring, which has protected the market from downside shocks for months.

With less protection and thinner liquidity, volatility could spike, making the market more unpredictable in the coming weeks.