Amid Market Crash, MARA Suddenly Spends $46 Million on Bitcoin — What Do They Know That We Don't?

MARA “collects” 400 Bitcoins after the historic crash, the market quickly recovers

Big buying move amid market turmoil

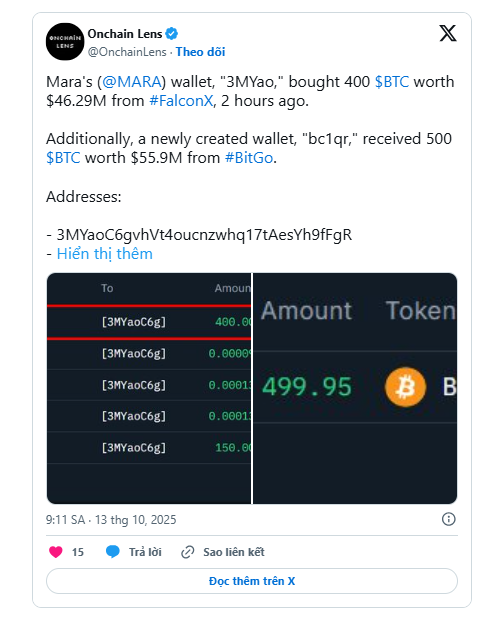

Amid the cryptocurrency market experiencing its largest liquidity crash in history , Bitcoin mining firm MARA Holdings purchased an additional 400 BTC worth approximately $46.3 million from liquidity provider FalconX.

This transaction was made through the “3MYao” wallet, bringing the total amount of Bitcoin held by MARA to more than 53,000 BTC , continuing to hold the position of the second largest Bitcoin owner in the world , only behind MicroStrategy with 640,031 BTC.

Bitcoin bounces back strongly after $19 billion drop

Bitcoin has recovered to $114,763, up 3.2% in 24 hours after a deep drop last weekend, according to CoinGecko.

The initial cause came from Donald Trump's statement about the possibility of imposing "massive tariffs" on China, causing the price of Bitcoin to fall from $121,000 to below $106,000 and evaporating more than $19 billion in investment positions .

However, the market quickly stabilized when Trump softened his tone, asserting that the US “wants to help China, not harm it” and calling President Xi Jinping a “highly respected” person.

Institutional investors see crashes as buying opportunities

Pav Hundal , Chief Analyst at Swyftx, commented:

“The market was in turmoil, but almost immediately people started buying.”

MARA is looking at the geopolitical picture and global economic outlook , he said, arguing that Bitcoin “still has room to rally” amid falling oil prices and demand that could prompt global monetary policy easing.

Although MARA shares fell 7.75% to $18.64 , investors still saw this as a positive sign that long-term confidence in Bitcoin has not weakened.