Traders Panic, Blame Trump: “Tariffs Kill Bitcoin!”

Investors blame Trump, experts warn of deeper causes

The crash sent panic into the market.

Friday's plunge saw Bitcoin lose more than 10% in just 24 hours , at one point falling to $102,000 on Binance.

A total of $16.7 billion in long positions were liquidated , while shorts were only about $2.5 billion — a difference of nearly 7:1 .

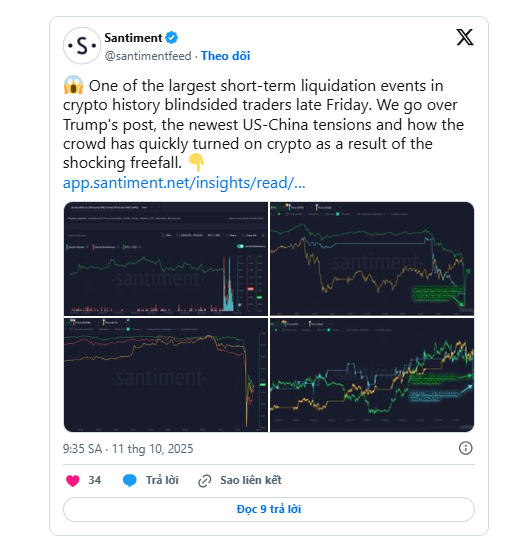

According to the Santiment platform , after the crash, many retail investors blamed US President Donald Trump's decision to impose 100% tariffs on Chinese goods , considering it the main cause of the crisis.

Expert: “Not just because of tariffs”

Analysts from The Kobeissi Letter say tariffs are just a catalyst, while the root of the problem lies in excessive leverage and risk-taking.

“This is a typical retail investor reaction — they always need a single reason to explain a total crash,” Santiment said.

In fact, after the price plunge, social media discussions about US-China tariffs and cryptocurrencies spiked, showing widespread panic in the community.

“Fear” prevails, Bitcoin loses its role as a safe haven

The Crypto Fear & Greed Index fell from “Greed” 64 to 27 , moving into “Fear” territory — its lowest level in nearly 6 months.

Santiment warns that if tensions between the US and China continue to escalate, predictions of Bitcoin falling below $100,000 could appear en masse.

However, if the Trump-Xi Jinping meeting brings positive signals, market sentiment could quickly improve.

As Santiment concludes: “Bitcoin, like it or not, is behaving more like a risk asset than a safe haven in times of international tension.”