Is “Sell in May” True for Bitcoin? Historical Data Reveals a Surprise!

Should You “Sell in May” as Summer Comes to the Bitcoin Market?

Summer is not necessarily a gloomy season.

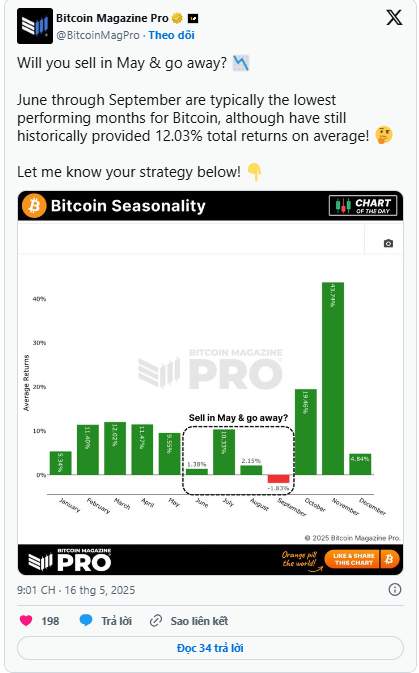

The question of “ Sell in May and go away” is once again being asked by cryptocurrency investors as summer approaches .

However, according to data from Bitcoin Magazine Pro , the June to September period, while not a boom time, was not entirely negative either .

Specifically, Bitcoin's monthly average during this period was:

June: +1.38%

July: +10.33%

August: +2.15%

September: -1.83%

In total, these 4 months still brought an average return of 12.03% , showing that the market is not as "cold" as many people mistakenly believe.

Stronger breakout months

In terms of peak performance , Bitcoin usually increases strongly in the last months of the year , especially:

October: +19.46%

November: +43.74%

March: +12.02%

February: +11.40%

This reinforces the view that the uptrend usually appears in the fourth quarter , when cash flows and market sentiment tend to be more positive.

What strategy for investors?

Instead of withdrawing all capital in the summer, investors should consider a flexible approach , depending on their risk appetite and investment goals .

Some people may choose to reduce their holdings or restructure their portfolios , while others maintain their positions, waiting for a breakout opportunity at the end of the year .

Historical data does not encourage hasty selling , but rather encourages a more strategic view.