Fundstrat's Tom Lee Predicts Crypto Prices Will Rise by Year-End, S&P 500 Could Rise Up to 10%

The cryptocurrency market is showing signs of a potential recovery as major indices start to turn positive. Experts say the bull run could finally consolidate as we enter the final weeks of 2025.

In a recent interview with CNBC, Fundstrat’s Tom Lee shared an optimistic outlook on both traditional and crypto markets.

The market has been experiencing significant volatility recently. Lee noted that on October 10, the cryptocurrency market experienced its largest liquidation in five years, in part due to escalating US-China trade tensions. Even two weeks later, he noted that the ripple effect is still affecting the market.

A Crypto Rally at the End of the Year?

However, despite the recent volatility, Bitcoin and Ethereum have held their ground. Lee noted that open interest for both Bitcoin and Ethereum is at record lows, while technical indicators for both coins are currently turning positive, suggesting improving market conditions.

“I think we’re almost past that point, because a metric like open interest for both Ethereum and Bitcoin is at record lows at a time when the technicals for both Bitcoin and Ethereum are turning positive. So I think we’ll see a crypto bull run later this year,” he said.

He also pointed to institutional signals, such as JPMorgan's willingness to use cryptocurrencies as collateral, as a key bullish factor.

Bitcoin's Resilience Amid Market Stress

Lee also noted that despite the recent historic deleveraging, Bitcoin only fell 3-4%. He believes this demonstrates Bitcoin's growing role as a reliable store of value. He also compared Bitcoin to gold, noting that a similar event in the gold market, causing such a small drop, would be seen as a strong endorsement of the asset.

He also noted that Ethereum is showing strong growth, especially activity on both Layer 1 and Layer 2 networks, fueled by stablecoins. While this growth has not yet been fully reflected in Ethereum's price, he noted that underlying activity on Ethereum is increasing, which could lead to a significant move by the end of the year.

Beyond cryptocurrencies, Lee believes the S&P 500, which is up more than 15% year-to-date, could rise another 4–10% by year-end, thanks to the Fed's rate cuts and investor skepticism.

Bitcoin shows technical strength

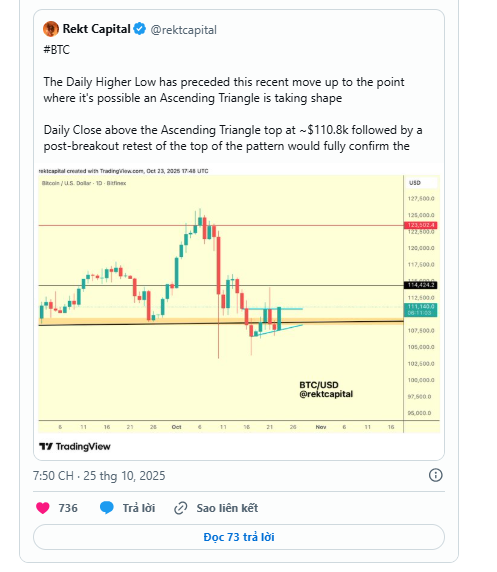

Analysts remain bullish on Bitcoin as technical indicators show signs of strength. Rekt Capital points out that BTC is close to breaking out of a daily ascending triangle pattern. Meanwhile, the weekend price action shows that Bitcoin is showing relative strength, currently outperforming its 16-week moving average.

With key indicators improving and institutional interest growing, the crypto market could see fresh momentum, setting the stage for a bull run by the end of the year.