Binance Buys Millions of Bitcoin, But Analysts Predict BTC Price to Drop 50%

With key indicators improving and institutional interest growing, the crypto market could see fresh momentum, setting the stage for a bull run by the end of the year.Bitcoin is once again on the ropes. Despite reports of Binance buying millions of BTC, leading crypto analysts are starting to warn that a sharp 50% correction could be closer than expected.

BTC price briefly surpassed $115,000, but many traders fear that this rally could be a trap, a preparation before a major correction occurs.

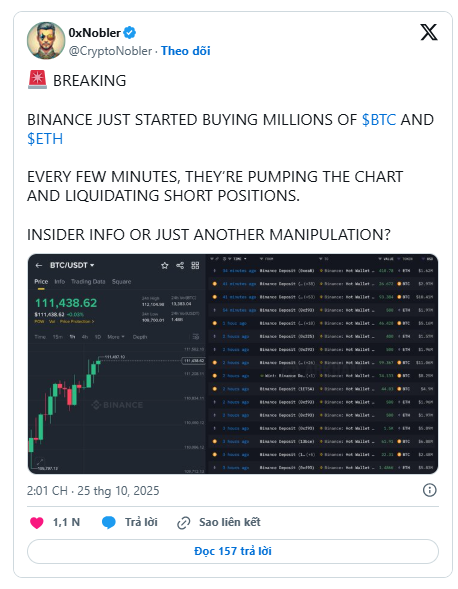

Cryptocurrency trader CryptoNobler recently spotted unusual activity on Binance, the world's largest exchange. He noted that Binance had been buying millions of dollars worth of Bitcoin, with some transactions exceeding 400 BTC.

While on-chain data shows the same wallets repeatedly moving funds, a pattern is often observed when exchanges manage internal liquidity or attempt to influence market volatility.

Tom Lee predicts a 50% correction for BTC

Adding to these concerns is Fundstrat Global Advisors co-founder Tom Lee, a longtime Bitcoin bull, who has warned investors about short-term risks.

In a recent interview, Lee said Bitcoin remains vulnerable to a 50% price correction, especially as the coin's price is strongly correlated with global stock market volatility.

Despite more than $20 billion flowing into Bitcoin ETFs since the start of 2025, Lee believes such withdrawals are part of Bitcoin's nature.

Bitcoin's Important Levels to Watch

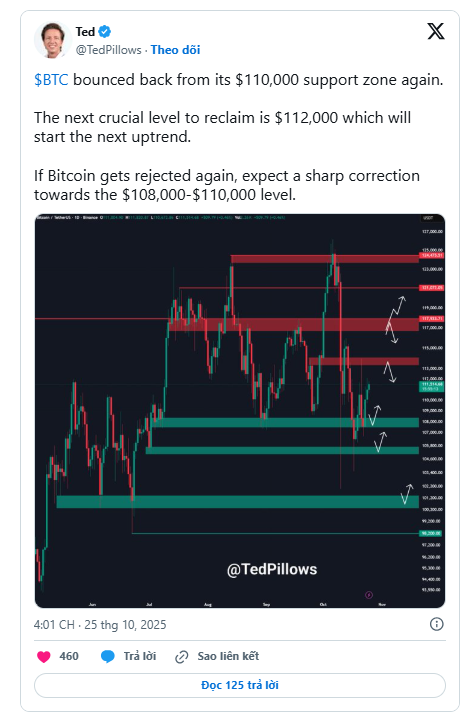

Social media was quickly awash with speculation. Popular cryptocurrency analyst Ted pointed out that Bitcoin may have bounced from the recent $115,000 support level, but the next key resistance level lies at $117,000.

“If Bitcoin continues to get rejected, expect a sharp correction towards the $108,000–$110,000 range.”

A rejection of the $112,000 level could open the door for a deeper decline, especially if Binance’s strong wallet movements turn out to be strategic liquidity activity rather than natural accumulation.