BlackRock is buying this altcoin for 2 weeks in a row?

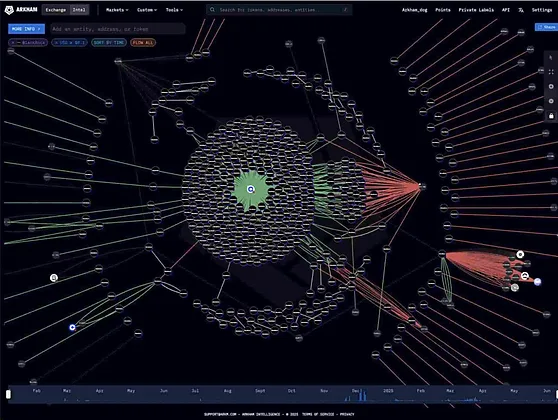

BlackRock , the world’s largest asset manager, has been buying Ethereum (ETH) every day for over two weeks, totaling $570 million as of June 11, according to Arkham Intelligence .

The move is notable for its large size and regularity, indicating BlackRock’s serious interest in Ethereum.

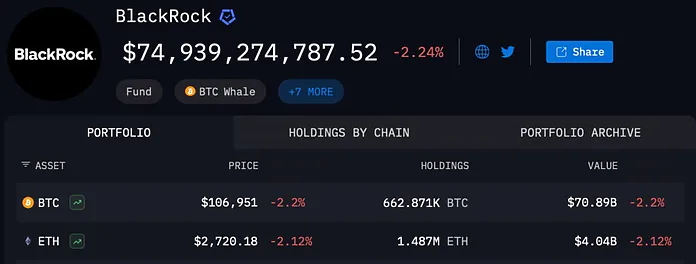

Currently, Ethereum is trading at $2,733 and BlackRock holds around 1.487 million ETH worth $4.06 billion .

While still smaller than the amount of Bitcoin they own ( 662,871 BTC , worth about $70.98 billion ), BlackRock's rapid accumulation of ETH is attracting attention.

BlackRock is buying ETH

BlackRock is stepping up its investment in Ethereum as the market awaits ETH ETF approval and interest in staking, tokenization, and DeFi grows.

This shows that large institutions are gradually viewing Ethereum as an attractive long-term investment due to its versatility and wide application.

While Bitcoin still leads, ETH is gaining more attention. Investors are watching to see if BlackRock will continue to buy aggressively in the coming period.