Altcoins Rise After the Longest “Crypto Winter” in History! 3 Factors That Are Pushing the Market to Explode Again!

Chinese Yuan and Gold Signal “Bullish Window” for Altcoins.

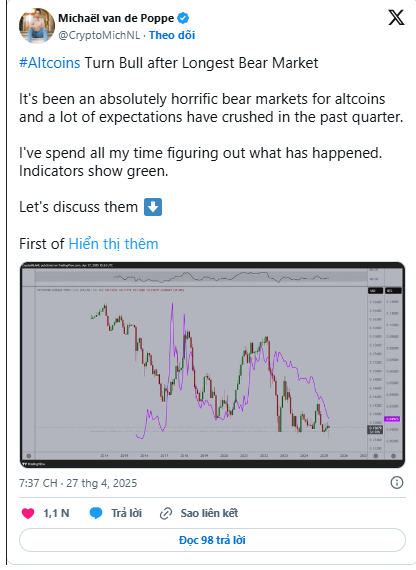

Veteran trader Michaël van de Poppe believes that the altcoin market is facing a great opportunity to explode again after a prolonged “crypto winter” .

He specifically highlighted the correlation between the Chinese Yuan (CNH/USD) exchange rate and the ETH/BTC pair , arguing that CNH/USD has bottomed similarly to 2016 and 2019 , periods that marked the beginning of strong altcoin growth.

He affirmed:

“Altcoins just experienced their longest bear cycle ever — lasting four years, longer than the 2016 period by just over two years. Now, the macro signals are reversing.”

C moves cash flow from gold to crypto

Van de Poppe said gold prices have hit a short-term peak at $3,500 an ounce , and investors may shift money to high-risk assets like crypto .

He sees this as a “ 12–18 month window for risk assets ,” amid an overheated gold rally and Ethereum at its lowest level relative to Bitcoin on the weekly and monthly charts.

Gold's RSI has crossed the same level as in 1980, while ETH is undervalued, creating favorable conditions for an altcoin "revival " .

Global liquidity loosens, Bitcoin and altcoins benefit

Ultimately, the deciding factor that Van de Poppe highlights is the surging global liquidity .

He listed: China started quantitative easing (QE) , Europe lowered interest rates , and the US prepared to pump money back . This is the ideal environment for Bitcoin to head towards a new price peak , pulling altcoins to recover strongly.

Currently, ETH/BTC is trading around 0.01894 BTC ($1,798) .