$5.6 Billion in Bitcoin and Ethereum Options Expire

It was a wild week for the cryptocurrency market, with Bitcoin (BTC) breaking its previous all-time high to hit $126,198. But just as traders were celebrating, the market was preparing for a storm, with over $5.6 billion in Bitcoin and Ethereum options expiring, marking the largest expiration in recent weeks.

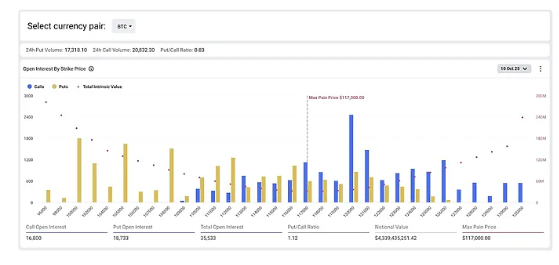

$4.6 Billion Bitcoin Options Are About to Expire

According to Deribit , the world's leading cryptocurrency options exchange, Bitcoin leads the way with $4.6 billion in options contracts expiring. There are currently about 384,483 contracts open.

The Put/Call ratio is 0.80, meaning there are more bullish call options than bearish put options.

The “maximum pain” price, the price at which most contracts could expire worthless, is $117,000, below the current Bitcoin price of $121,743. BTC has fallen slightly over the past 24 hours and its market capitalization is now $2.43 trillion.

$1 Billion Ethereum Options Expiration Date

Ethereum (ETH) also faces significant expiration dates, albeit smaller than Bitcoin. According to data from Deribit, about $1.06 billion in ETH options, or 2,467,751 contracts, are set to expire this week.