Veteran Trader Warns a Major Correction Is Coming, Holds BTC and ETH

The recent surge in both the stock and cryptocurrency markets has left many traders bullish. But not everyone shares that belief. A veteran trader, Wealthmanagerrr, sparked controversy on X after revealing that he had sold most of his positions and warning that the market could face a sharp correction in the coming months.

And his concern was not just intuition, the data proved his claim.

Rising margin debt causes warning

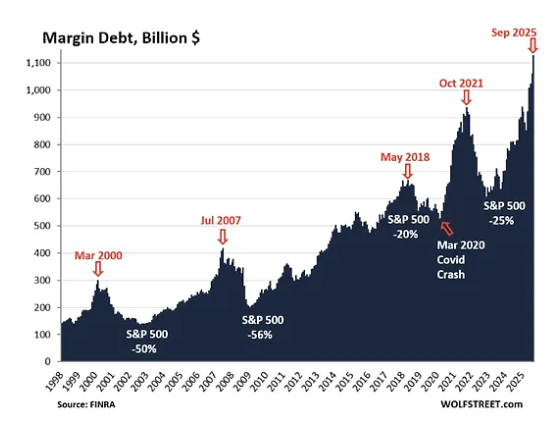

According to new data from FINRA, U.S. margin debt has soared above $1.1 trillion, the highest level on record. That figure even surpasses levels before the major market crashes in 2000, 2008, and 2021.

This means many investors are borrowing large sums of money to buy more stocks and cryptocurrencies in the hope of making bigger profits. But history shows that such excitement often ends badly. When prices start to fall, those same investors are forced to sell to repay their debts, causing prices to fall even faster.

The trader warned that this excessive use of debt could cause a “chain reaction” if market confidence suddenly disappears.

Past crashes show the market will fall 25%

But the warning is not without merit. In 2000, when margin debt peaked, the S&P 500 fell nearly 50%. In 2008, it fell 56%. Even in 2021, high leverage has led to a 25% correction.

Each time, excessive leverage plays a role.

Now, with margin debt higher than ever and inflation rising, this situation seems all too familiar.

Additionally, recent comments from Fed Chairman Jerome Powell that another rate cut in December was not a “foregone conclusion” added to the pressure, strengthening the dollar and dampening investor sentiment just when markets were once again looking stressed.

Stocks and cryptocurrencies could be next targets

While many retail investors continue to “buy the dip,” this trader has gone the opposite direction. He has exited most of his positions, holding only Bitcoin and Ethereum for the long term, and moved the rest into stablecoins.

He predicts a major correction in the next 3–9 months, affecting both the stock and crypto markets.

With the cost of living continuing to rise and borrowing costs remaining high, he believes the market is “overextended” and will see major volatility.