US Set to Pass Comprehensive Cryptocurrency Bill: Opportunity to Reposition as Global Leader?

Pat Toomey advocates new regulatory framework for stablecoins, calling on the US Senate to pass legislation to lead global digital financial technology.

The regulatory landscape of the digital asset industry in the United States may be about to take a major turn. In a recent interview on Bloomberg TV, former Senator Pat Toomey – now a member of Coinbase’s Global Advisory Board – revealed that a comprehensive cryptocurrency regulatory bill is very close to the Senate .

If passed, the bill would pave the way for a clearer regulatory framework while also enabling the US digital asset ecosystem to regain its global competitive edge.

“If we don't act, America will fall behind”

Toomey made no secret of his concern that the United States is losing its lead in the digital currency race. He warned that the lack of a transparent and supportive regulatory framework will cause innovative companies to leave the United States and move to countries with more friendly regulatory environments such as Singapore, Hong Kong or the UAE.

Toomey emphasized:

There is no guarantee that the United States will continue to dominate the digital asset space unless we pass sensible regulations and promote innovation.

One of the important contents of this bill is to establish legal standards for stablecoins - a rapidly growing sector that still lacks comprehensive supervision in the US.

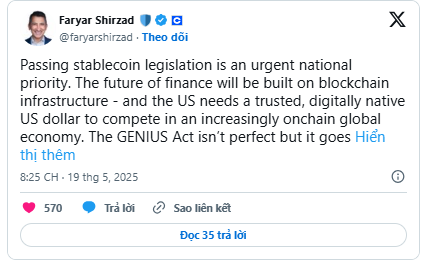

According to a post shared on the X platform, former Senator Pat Toomey expressed his agreement with Faryar Shirzad , Coinbase’s co-head of global policy.

Toomey stressed that the new legal framework for stablecoins is not only aimed at regulation but also aims to meet global standards of transparency, security, and risk control.

In doing so, the United States can reaffirm its pioneering role in issuing and deploying transparent, trustworthy, and user-friendly stablecoins globally.

This is all the more significant as stablecoins like USDC or USDT are increasingly playing an essential role in the DeFi ecosystem, cross-border payments, and traditional finance.

Growth and user protection go hand in hand

Toomey said the bill not only encourages innovation but also includes strong consumer protection provisions , drawing on painful lessons learned from major scandals like FTX, Celsius, and Terra.

The goal is to build strong trust with the public and investors , thereby expanding the use of digital assets in practical applications such as remittance, payments, and financial inclusion.

Will there be obstacles from other bills?

There has been some speculation that the controversial Credit Card Competition Act could be “attached” to the cryptocurrency bill during the vote, but Toomey dismissed that possibility:

That would be a big mistake. Combining these two unrelated topics will only complicate the adoption process.

While the cryptocurrency bill has strong bipartisan support, the credit card bill is deeply divisive.

Market Impact and Long-Term Outlook

Observers say Bitcoin’s recent surge – surpassing $110,000 – is partly due to expectations that the Senate will pass new legislation related to stablecoins and digital assets. The House of Representatives has already given the green light to several financial bills, raising hopes of an upcoming consensus in the Senate.

If passed, this bill would be a historic step forward for the cryptocurrency industry in the US , establishing a transparent and safe playing field for developers, businesses, and investors – from retail to institutional.

Ultimately, former Senator Pat Toomey argues, this legislation is a strategic opportunity for the United States to regain leadership in the global race for digital assets . The combination of consumer protection, innovation promotion, and global compatibility will create a more sustainable and competitive ecosystem.