Is Gold's Surge an Urgent Warning Sign for Bitcoin and the Global Economy?

Gold has been in the spotlight in 2025. Spot gold recently broke through $4,300 an ounce for the first time, marking a record high. Typically, in times of uncertainty, investors turn to the US dollar or Treasury bonds. This year is different. Gold is the safe haven of choice for many, and people are starting to notice.

The rally has been relentless. Since the start of 2024, gold has nearly doubled in price, leaving stocks, bonds and even cryptocurrencies struggling to keep up.

But why? If you are wondering the same thing, let’s find out.

Why is gold rising so strongly?

Gold is simple. It holds value and, unlike industrial commodities, it is not dependent on factories or technology. It is reliable, easy to trade, and a proven method of protecting wealth.

Gold has historically surged during crises: $1,000 in 2008, $2,000 in 2020, and $3,000 after Trump's tariffs. Today's rally builds on these patterns but is under pressure from multiple fronts.

Investors are concerned about government debt, financial stability and the independence of the US Federal Reserve. Low interest rates and inflation concerns make gold more attractive than cash or bonds.

Are people losing faith in the dollar?

The US dollar, long considered the default safe haven, is under pressure. In 2025, the US dollar recorded its biggest six-month decline in 50 years . Investors are withdrawing money from fiat currencies and moving into gold – a move experts call the “ Dumping Trade ”.

Political pressure on the Federal Reserve, tariffs and global tensions only add fuel to the fire. That uncertainty makes gold look even safer.

China and Central Banks Lead Demand

Geopolitics is reshaping the gold market. After Russia’s invasion of Ukraine in 2022, countries began diversifying their foreign exchange reserves away from the dollar. Central banks now buy about 1,000 tons of gold a year, a major reversal from previous decades.

China is at the center of this trend. The People's Bank of China is reducing its holdings of US Treasuries and buying gold to support de-dollarization. As the world's largest gold consumer and producer, China's move has global implications and supports stable gold prices.

ETFs and Retail Investors

Gold-backed ETFs are also driving the rally. By allowing investors to trade gold like a stock, ETFs have opened the market to both retail and institutional investors. Inflows in September 2025 were six times higher than expected, indicating strong demand.

Silver and platinum are rising alongside gold, although their industrial uses provide slightly different market dynamics.

Bitcoin vs. Gold: Still a Long Way to Go

Bitcoin is struggling to keep up with gold’s growth. Gold’s market capitalization is now $30 trillion, while BTC would need to grow 1,500% to reach the same level. Year-to-date, gold is up about 65%, while Bitcoin is up just 11%.

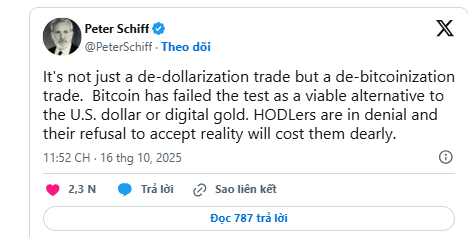

“This is not just a de-dollarization of the exchange, it is a de-bitcoinization of the exchange,” said prominent Bitcoin skeptic Peter Schiff. “Bitcoin has failed the test of whether it is a viable alternative to the US dollar or digital gold.”

Some remain optimistic, such as Mexican billionaire Ricardo Salinas , who believes Bitcoin could rise 14-fold to catch up with gold. But for now, gold remains the top safe haven.

What's next?

The gold rally is unlikely to slow anytime soon. Analysts at Goldman Sachs and Deutsche Bank predict gold could hit $4,900 by year-end, fueled by central bank buying, ETF demand and ongoing geopolitical uncertainty.

Any resolution to trade tensions or conflicts could dampen the rally, but for now, gold is the safe haven investors trust.

Bitcoin and other cryptocurrencies could recover if institutional interest increases, but for now, attention remains on gold.