Gold plummets, Bitcoin ETF explodes with over $477 million poured in!

Big money flows back to Bitcoin ETF: Strong recovery signal from institutional investors

$477 million in capital flows into Bitcoin ETF after volatile period

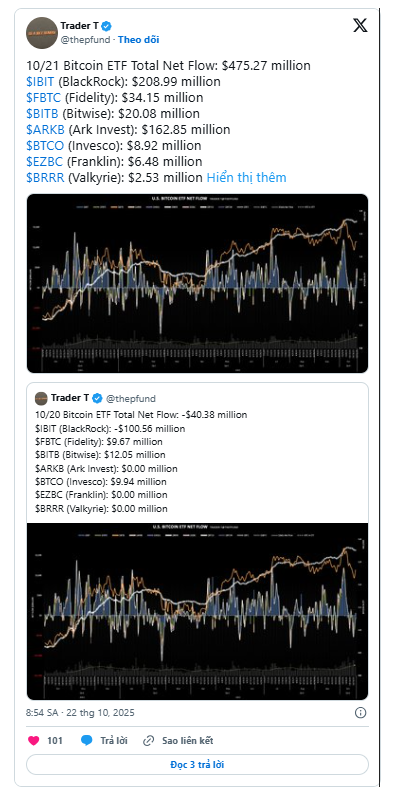

The US cryptocurrency market recorded a net inflow of $477.2 million into spot Bitcoin ETFs on Tuesday, marking the return of institutional investors after a period of strong volatility.

According to data from SoSoValue , nine out of 12 Bitcoin ETFs recorded positive inflows, with BlackRock's IBIT leading the way with $210.9 million, followed by Ark & 21Shares' ARKB ($162.8 million) and Fidelity's FBTC ($34.15 million).

On the same day, Ethereum ETFs also recorded $141.6 million in inflows , with Fidelity's FETH fund accounting for $59 million.

Institutional investors increase positions, market liquidity improves

According to Nick Ruck , Research Director at LVRG Research, “Yesterday’s flows show that institutional investors are restructuring portfolios despite recent volatility, reinforcing crypto’s role as a diversifier during times of economic uncertainty.”

Total Bitcoin ETF trading volume reached $7.41 billion , within the strong $5–9.7 billion range of October, showing growing participation from financial institutions.

“The increase in trading volume over the past month reflects renewed momentum in institutional investor interest in digital assets,” Ruck noted.

Gold falls sharply, crypto becomes new destination for cash flow

The return of crypto investment capital comes as gold prices fell 5.9% — their biggest drop since 2020.

According to Ruck, demand for gold is weakening , and investors may turn to digital assets with more attractive risk/reward ratios .

Some experts also predict that Bitcoin could enter a "strong recovery" after the precious metal loses its appeal, opening up opportunities for the cryptocurrency market in the coming period.