Fed Rate Decision May 7: What It Means for Crypto Markets

With the next meeting of the US Federal Reserve coming up on May 7, traders and analysts seem to agree on one thing: there is little chance of a rate hike or cut this time around. But that doesn't mean markets will be calm, far from it.

All eyes are now on what Jerome Powell will say in his press conference and how the economy will perform in June.

May: No changes expected

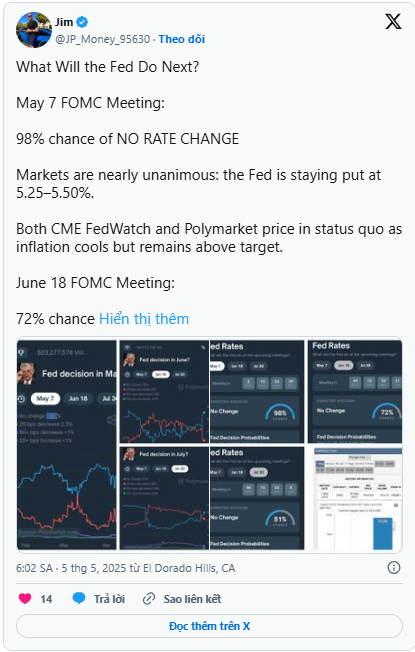

Polymarekt, a prediction market, predicts that there is a 98% chance that the Fed will leave interest rates unchanged at its May meeting. On the other hand, there is a 2% chance that rates will be cut by 25 bps in May.

With inflation slowing but still above the Fed’s 2% target, and interest rates already at 5.25% to 5.50%, their highest in more than two decades, the central bank appears content to wait and see.

But while a “pause” in May is all but certain, markets are not only watching what the Fed does but also listening closely to what Fed Chairman Jerome Powell says.

June: A turning point?

June is where things get interesting, with a 72% chance the Fed will leave rates unchanged at its June meeting. Other market odds put the chance of a rate cut at around 25%, and that number could rise if job growth slows or inflation falls further.

This makes upcoming reports on inflation and jobs important. A weak jobs report or weaker consumer price data could tip the balance in favor of a rate cut.

On the other hand, if inflation remains high, the Fed will likely maintain its current stance or even begin discussing keeping interest rates high for a longer period of time.

Powell's tone is more important than ever

Interestingly, markets may react more to what Fed Chairman Jerome Powell says than what the Fed does. If he sounds too hawkish, using phrases like “persistent inflation” or “insufficient progress,” markets could sell off sharply.

Tech stocks and interest-rate sensitive sectors could fall, bond yields could rise rapidly, the US dollar could strengthen and assets like Bitcoin or gold could lose momentum.